Ny State Solar Tax Credit Form

Form rp 487 from new york state department of taxation and finance.

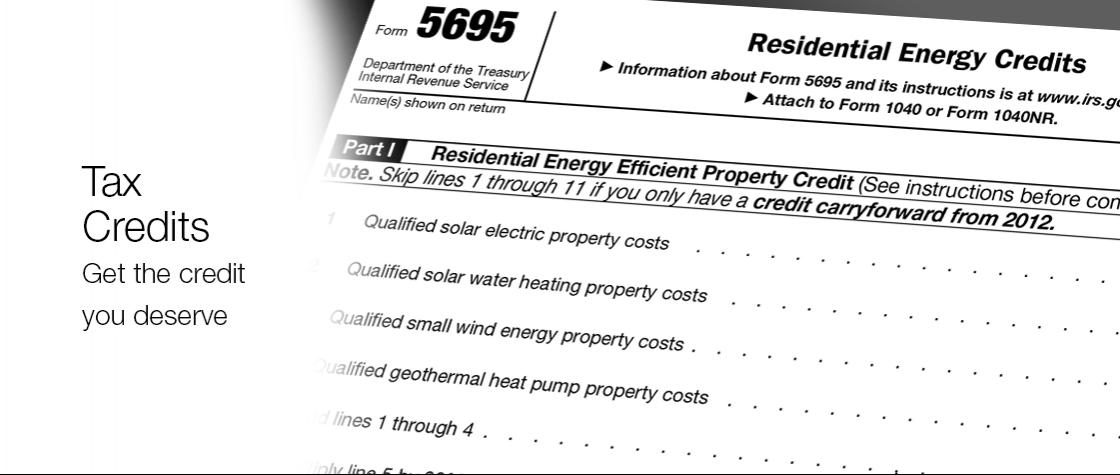

Ny state solar tax credit form. You must each file form it 255 showing the computation of the total credit and submit the statement described. The great advantages of the solar equipment tax credit are twofold. How much is the credit. The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower.

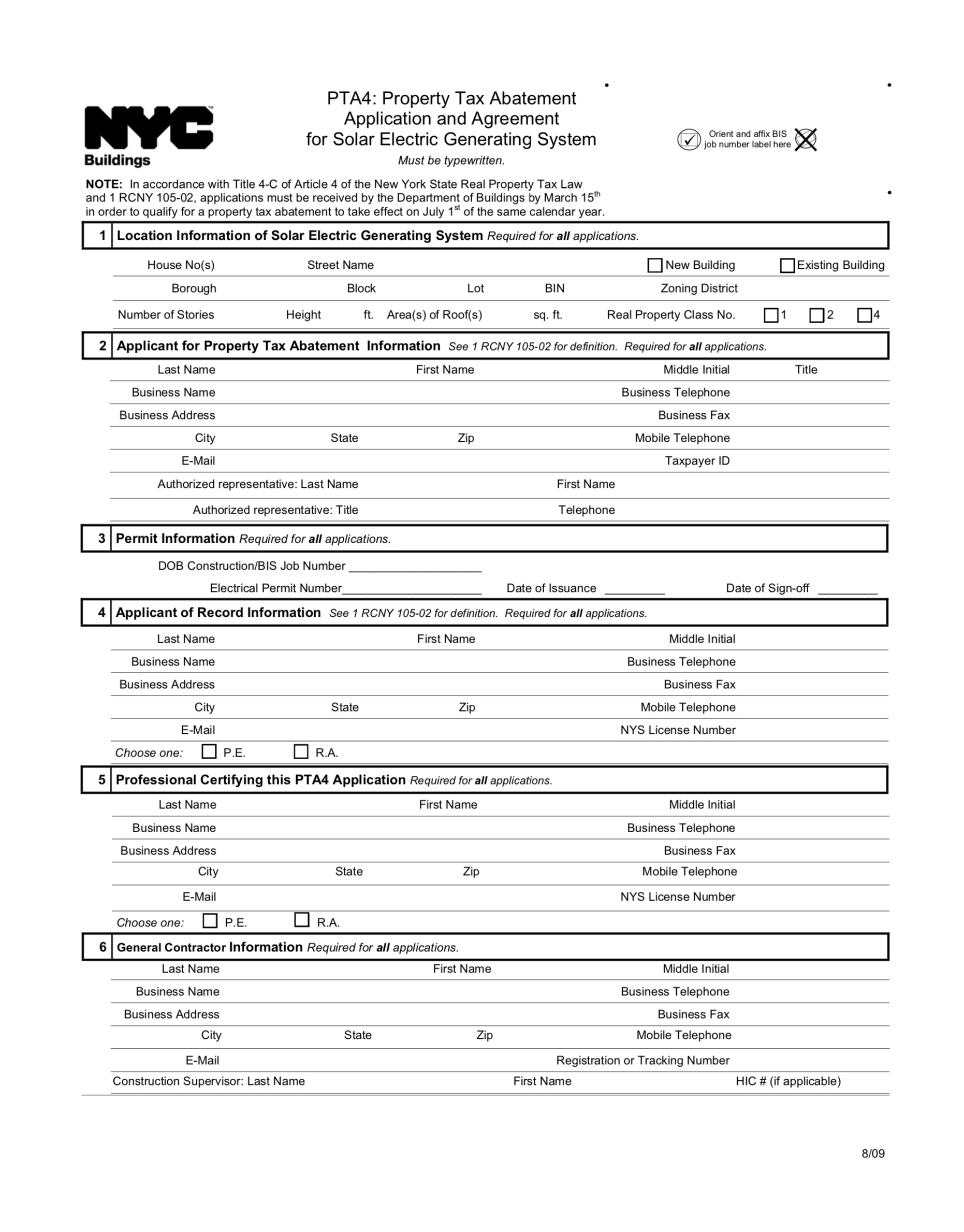

Schedule a computation of solar energy system equipment credit a date equipment placed in service mmddyyyy b qualified expenditures see instructions c. As a part of its ambitious reforming the energy vision initiative 2 new york is making solar accessible to households across the empire state. File this form with your local property assessor. You each pay one half of the cost of the solar energy system equipment.

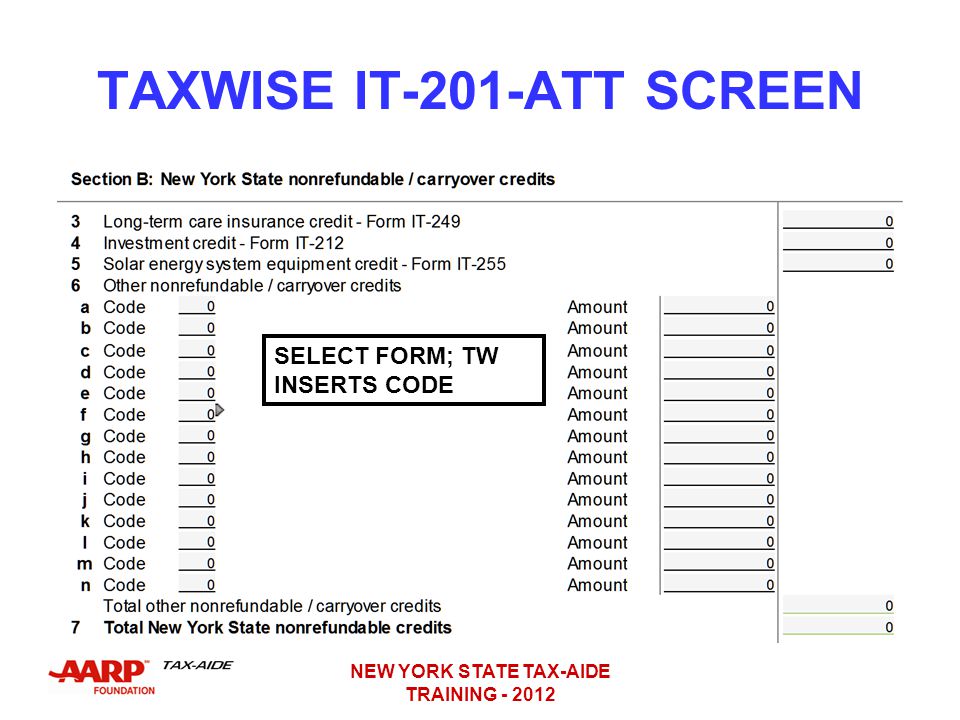

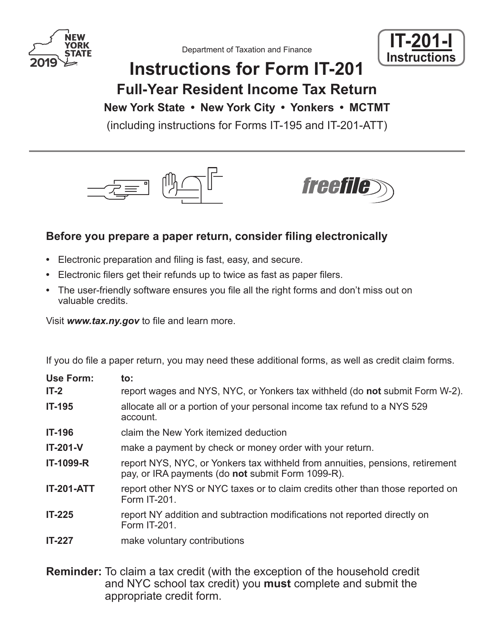

Some municipalities and school districts have opted out and will include the value of the solar installation in your property tax assessment without the exemption. Claim for solar energy system equipment credit tax law section 606 g 1 name s as shown on return your social security number it 255 submit this form with form it 201 or form it 203. You must claim one half of the total credit on your new york state return and your father would claim the other half of the credit on his new york state return. The system must also be installed and used at your principal residence in new york state.

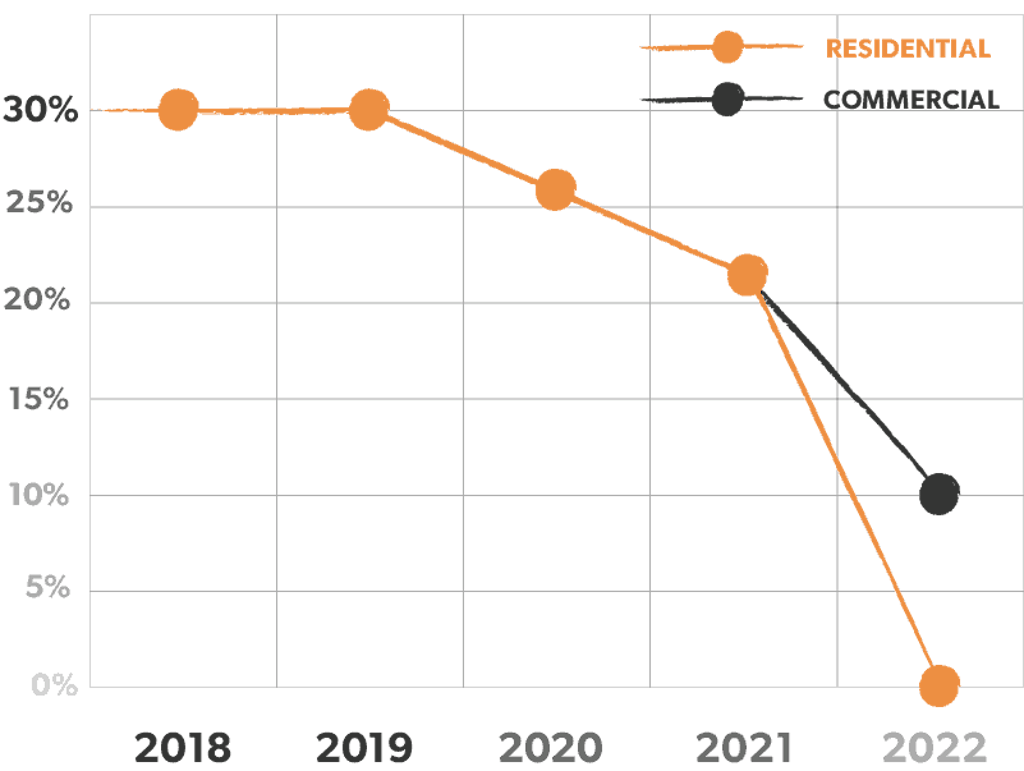

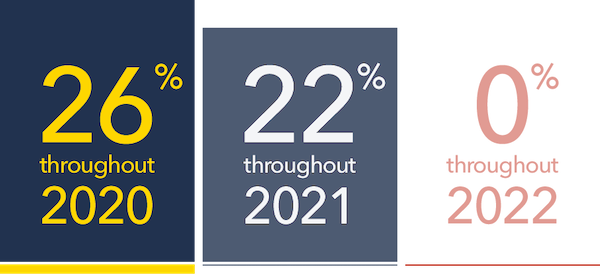

Learn how you can benefit from new york s solar incentives rebates tax credits today. The solar energy system equipment credit is not refundable. The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000. First you don t have to purchase your system to claim the credit i e.