Ny State Tax Credit For Solar Panels

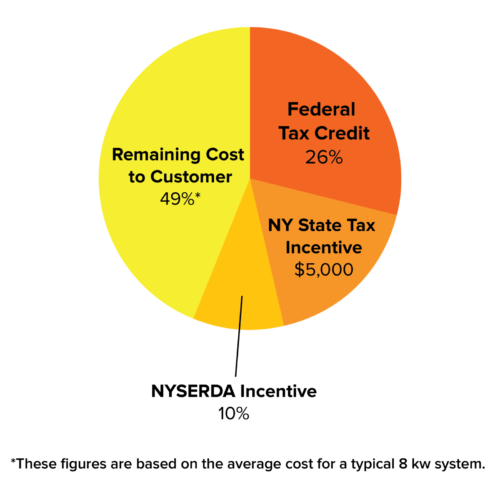

Thanks to rebates solar tax credits and exemptions new yorkers could earn back up to 40 on the up.

Ny state tax credit for solar panels. A similar tax credit is available at the state level for systems up to 25 kilowatts in capacity. The second most important incentive for solar panel installations in new york is the state solar tax credit which allows you to potentially earn an extra 5 000 to put towards your taxes on top of the federal solar tax credit. New york is a top 10 solar state 1 and for good reason. The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000.

As a part of its ambitious reforming the energy vision initiative 2 new york is making solar accessible to households across the empire state. New york state tax credit. The solar energy system equipment credit is not refundable. The great advantages of the solar equipment tax credit are twofold.

For instance if your system costs 15 000 you d be able to take a 3 750 tax credit on your state taxes. How much is the credit. New york s residential solar tax credit is equal to 5 000 or 25 percent of the cost of your solar system whichever is less. It applies to you even if you went solar with a lease or.

If you re a new york state resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing. In addition to our incentive programs and financing options you may qualify for federal and or new york state tax credits for installing solar at home. The system must also be installed and used at your principal residence in new york state.