Nys Solar Tax Credit 2020

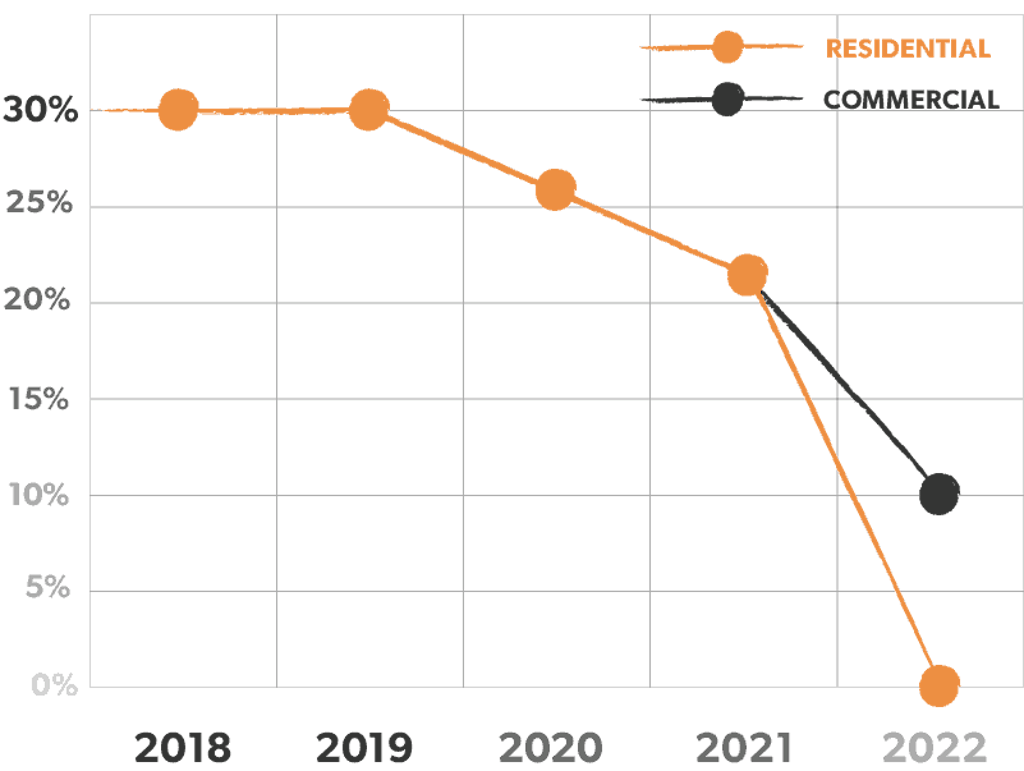

Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

Nys solar tax credit 2020. It applies to you even if you went solar with a lease or. Are you a full or part year new york city resident. New york city credits. The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower.

If you install solar panels before the end of 2020 you will receive a tax credit that is equal to 26 percent of the cost of your solar installation. The great advantages of the solar equipment tax credit are twofold. The federal solar tax credit also known as the solar investment tax credit or itc is the single most important solar incentive available in the united states. New york state offers several new york city income tax credits that can reduce the amount of new york city income tax you owe.

For instance if your system costs 22 000 you could take a tax credit of 6 600 on your federal taxes. The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000. The most significant solar incentive available for new yorkers in 2020 is the federal investment tax credit itc. First you don t have to purchase your system to claim the credit i e.

If you re a new york state resident interested in filing for a renewable energy tax credit you will need to complete the appropriate forms to submit along with your normal yearly tax filing. There s no dollar limit on the credit for most types of property although the credit for fuel cells is capped at 500 per half kilowatt of power capacity. Owners of new commercial solar energy systems can deduct 10. If say your federal taxes are 6 000 for 2020 and you re eligible for a 7 000 tax credit for installing a solar system at your house you can claim the leftover 1 000 as a credit toward your.

What does the federal solar tax credit extension mean for the solar industry. The tax credit remains at 30 percent of the cost of the system. Solar hot water heaters solar electric equipment wind turbines and fuel cell property are examples of equipment eligible for the tax credit. Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes.

The itc entitles you to a tax credit equal to 26 percent or your system s value. The solar energy system equipment credit is not refundable. A series of extensions pushed the expiration date back to the end of 2016 but experts believed that an additional five year extension would bring the. However any credit amount in excess of the tax due can be carried over for up to five years.