Nys Solar Tax Credit Form

To claim the federal solar tax credit you must file irs form 5695 as part of your tax return.

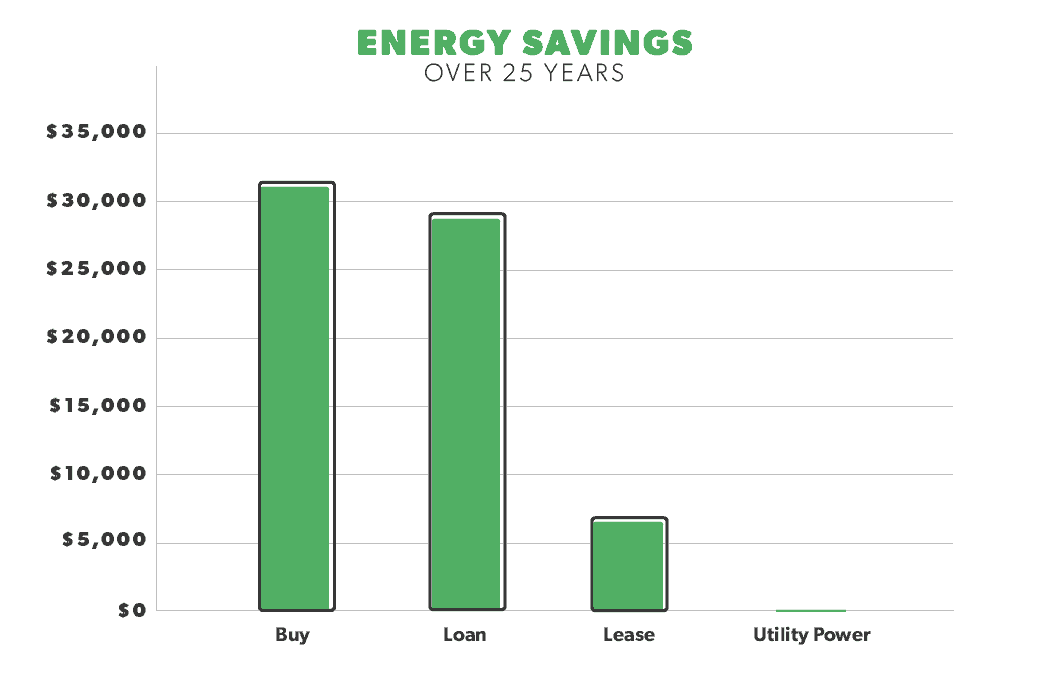

Nys solar tax credit form. New york offers a state tax credit of up to 5 000. It applies to you even if you went solar with a lease or. The new york solar tax credit can reduce your state tax payments by up to 5 000 or 25 off your total solar energy expenses whichever is lower. We ll use the national average gross cost of a solar energy system as an example.

Some municipalities and school districts have opted out and will include the value of the solar installation in your property tax assessment without the exemption. Form rp 487 from new york state department of taxation and finance. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file. However any credit amount in excess of the tax due can be carried over for up to five years.

The credit is equal to 25 of your qualified solar energy system equipment expenditures and is limited to 5 000. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit. First you don t have to purchase your system to claim the credit i e. Have questions about your solar tax credits.

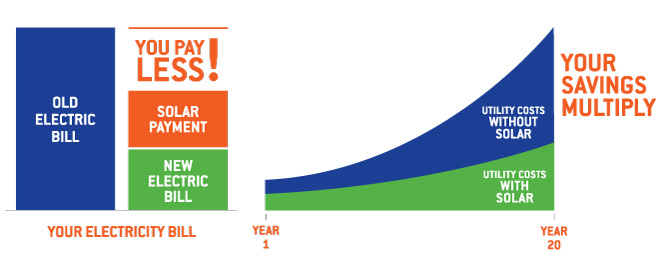

New york is a top 10 solar state 1 and for good reason. Schedule a computation of solar energy system equipment credit a date equipment placed in service mmddyyyy b qualified expenditures see instructions c. If you end up with a bigger credit than you have income tax due the excess amount may be carried forward to the succeeding taxable year 2017. Thanks to rebates solar tax credits and exemptions new yorkers could earn back up to 40 on the up.

Form 5695 calculates tax credits for a variety of qualified residential energy improvements including geothermal heat pumps solar panels solar water heating small wind turbines and fuel cells. You calculate the value of the solar tax credit on the form and then enter the result on form 1040. The great advantages of the solar equipment tax credit are twofold. There are so many incentives to go solar especially for new york residents.

Maryland s is 1 000 per system plus 30 percent of the cost to install a giant battery to store the energy that s produced. To learn more about solar tax credits and how going solar can help you save money give us a call today at 516 855 7283. To claim this credit fill out this form and include the final result of it on irs form 1040. Learn how you can benefit from new york s solar incentives rebates tax credits today.

The solar energy system equipment credit is not refundable.